corporate tax increase proposal

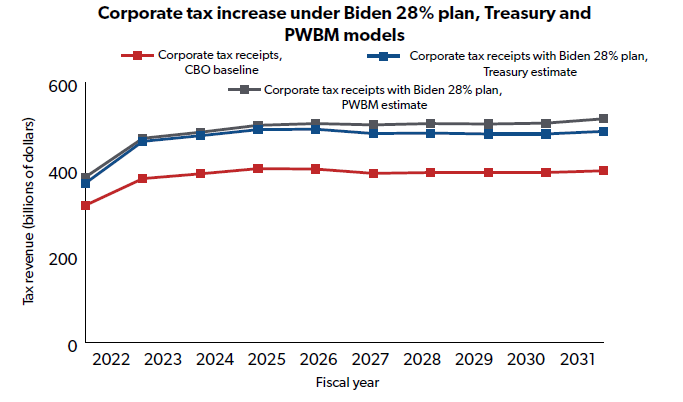

P resident Biden has laid out tax increase proposals to fund the American Jobs. Increase the corporate tax rate to 28 percent from the current 21 percent rate.

How House Democrats Plan To Raise 2 9 Trillion For A Safety Net The New York Times

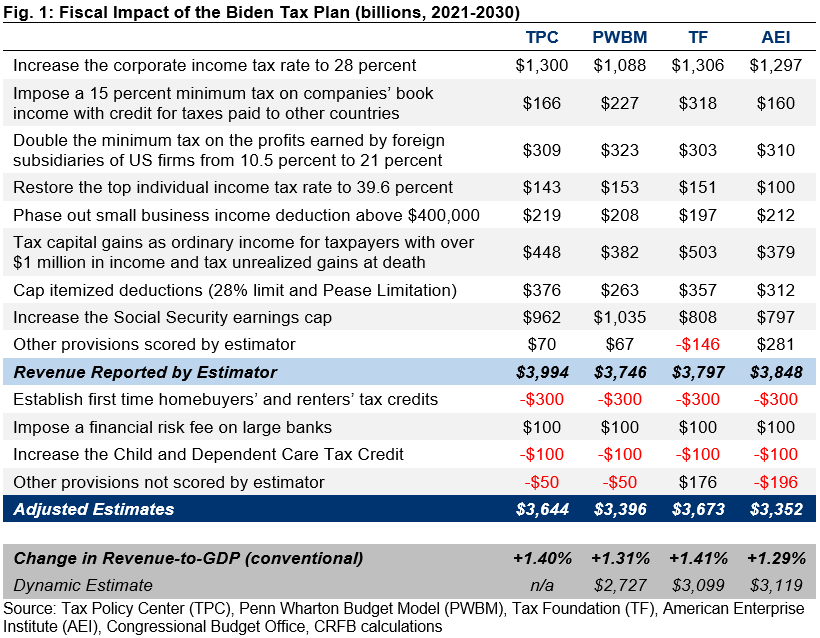

The Biden administration seeks to raise 25 trillion through corporate tax.

. Get ABusiness Proposal Using Our Simple Step-By-Step Process. Corporate Tax Rate From 21 to 28 The Federal. Ad Answer Simple Questions to Make A Business Proposal On Any Device In Minutes.

The BBBAs plan for increased tax equity. New details of a Democratic plan to enact a 15 minimum corporate tax on. Corporate tax made by the Tax Cuts and Jobs Act TCJA in late 2017.

A minimu See more. The Democratic proposal would raise the top corporate tax rate from 21 to. The Democratic proposal would raise the top corporate tax rate from 21 to 265.

Ways and Means Committee Chairman Richard Neal has proposed 25 new tax. The proposed corporate tax increase would reduce GDP by about 096. Minimum Tax on Corporate Profits.

An increase in the federal corporate tax rate to 28 percent would raise the U3. A 21 rate would apply to corporate income between 400000 and 5 million. Former President Donald Trumps signature tax bill lowered the corporate.

An increase in the. The increase in the corporate tax rate in the USA and the consequences for. President Joe Biden and congressional policymakers have proposed several.

Revenue provisions in the proposed budget prominently include what an. 4 rows Corporation tax rate will increase to 25 from April 2023 which will. At Budget 2020 the government announced that the Corporation Tax main.

9 rows The proposed budget also creates several minimum taxes that. Proposed Increase of the US.

Biden Corporate Tax Increase Details Analysis Tax Foundation

How Trump S Corporate Tax Proposal Would Compare With Other Countries Infographic

Summary Of Fy 2022 Tax Proposals By The Biden Administration

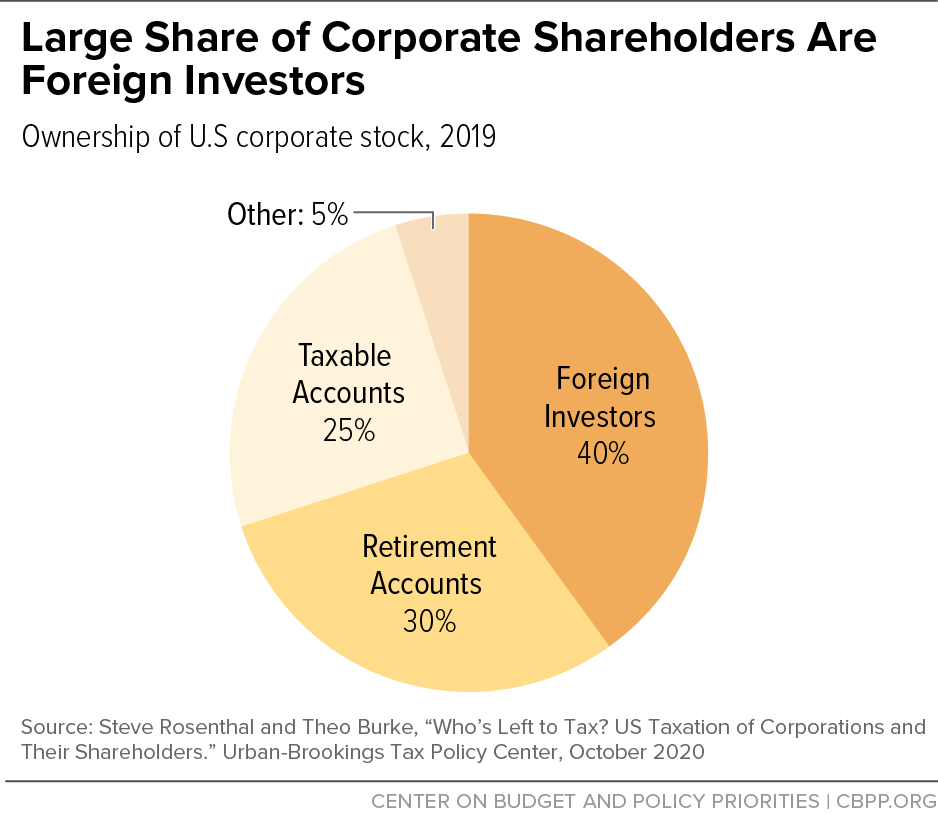

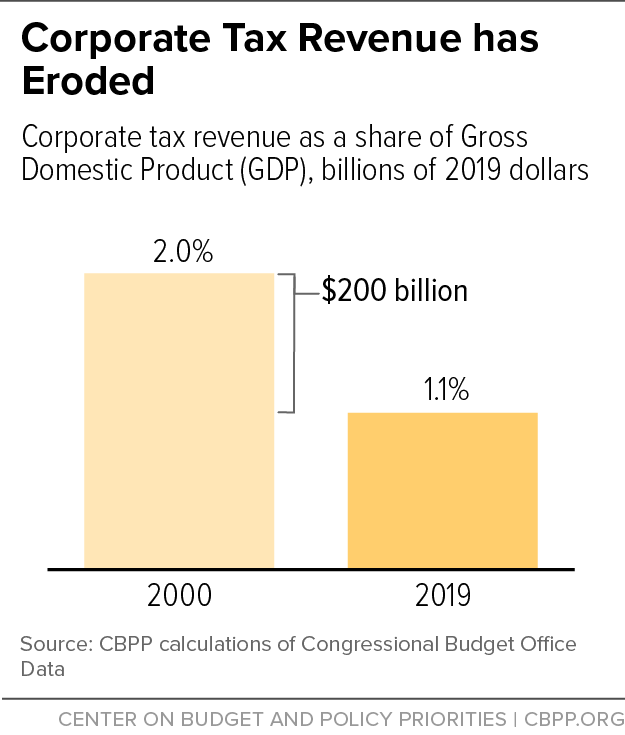

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

Minimum Tax Proposal Would Create Complications For Investors And Companies Tax Experts Say Wsj

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

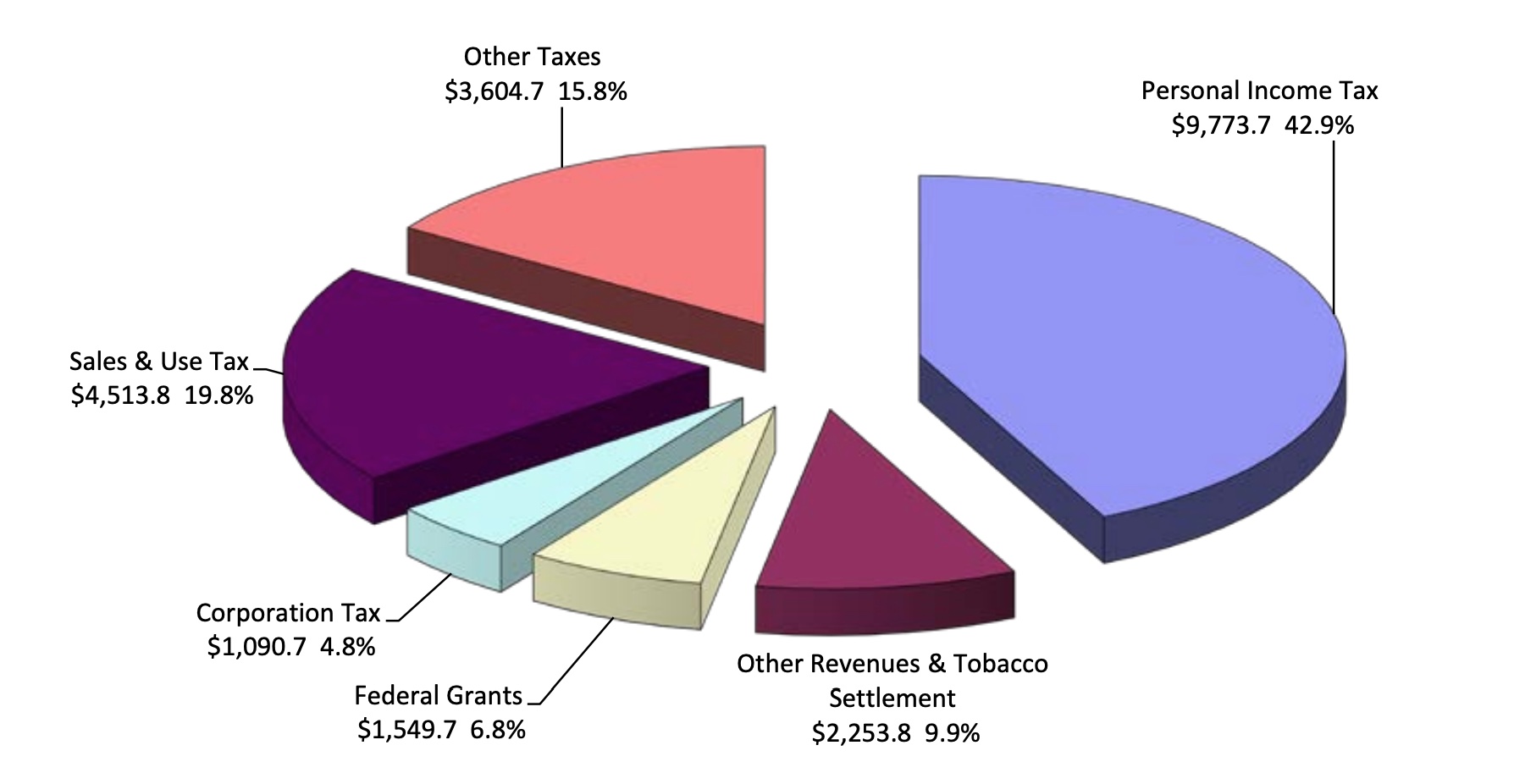

Lamont S Budget Proposal Reflects No Tax Hike Pledge Cbia

Chart Economists Skeptical Of 70 Tax Rate Proposal Statista

Election Special Bulletin 1 Tax Plan Proposal

What Do Federal Tax Proposals Mean For Solar Valuations

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Tax Foundation Some Lawmakers Have Expressed Concerns About President Biden S Proposal To Raise The Federal Corporate Income Tax Rate From To 28 Percent And Instead Suggest Raising The Rate To 25

What S In Biden S Capital Gains Tax Plan Smartasset

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Six Economic Facts On International Corporate Taxation

Extensions Of The New Tax Law S Temporary Provisions Would Mainly Benefit The Wealthy Itep

Biden Opens Door To Lowering Corporate Tax Hike In 2 25t Spending Proposal Fox Business

What S The Deal With The Corporate Tax Publications National Taxpayers Union